Condo Insurance in and around Huber Heights

Huber Heights! Look no further for condo insurance

State Farm can help you with condo insurance

Your Possessions Need Coverage—and So Does Your Townhome.

Often, your safe place is where you are most able to take it easy and enjoy your favorite people. That's one reason why your condo means so much to you.

Huber Heights! Look no further for condo insurance

State Farm can help you with condo insurance

Safeguard Your Greatest Asset

That’s why you need State Farm Condo Unitowners Insurance. Agent Nathan Baker can roll out the welcome mat to help provide you with coverage for your particular situation. You’ll feel right at home with Agent Nathan Baker, with a no-nonsense experience to get dependable coverage for your condo unitowners insurance needs. Personalized care and service like this is what sets State Farm apart from the rest. Agent Nathan Baker can help you file your claim whenever the unexpected happens. Home can be a sweet place to be with State Farm Condominium Unitowners Insurance.

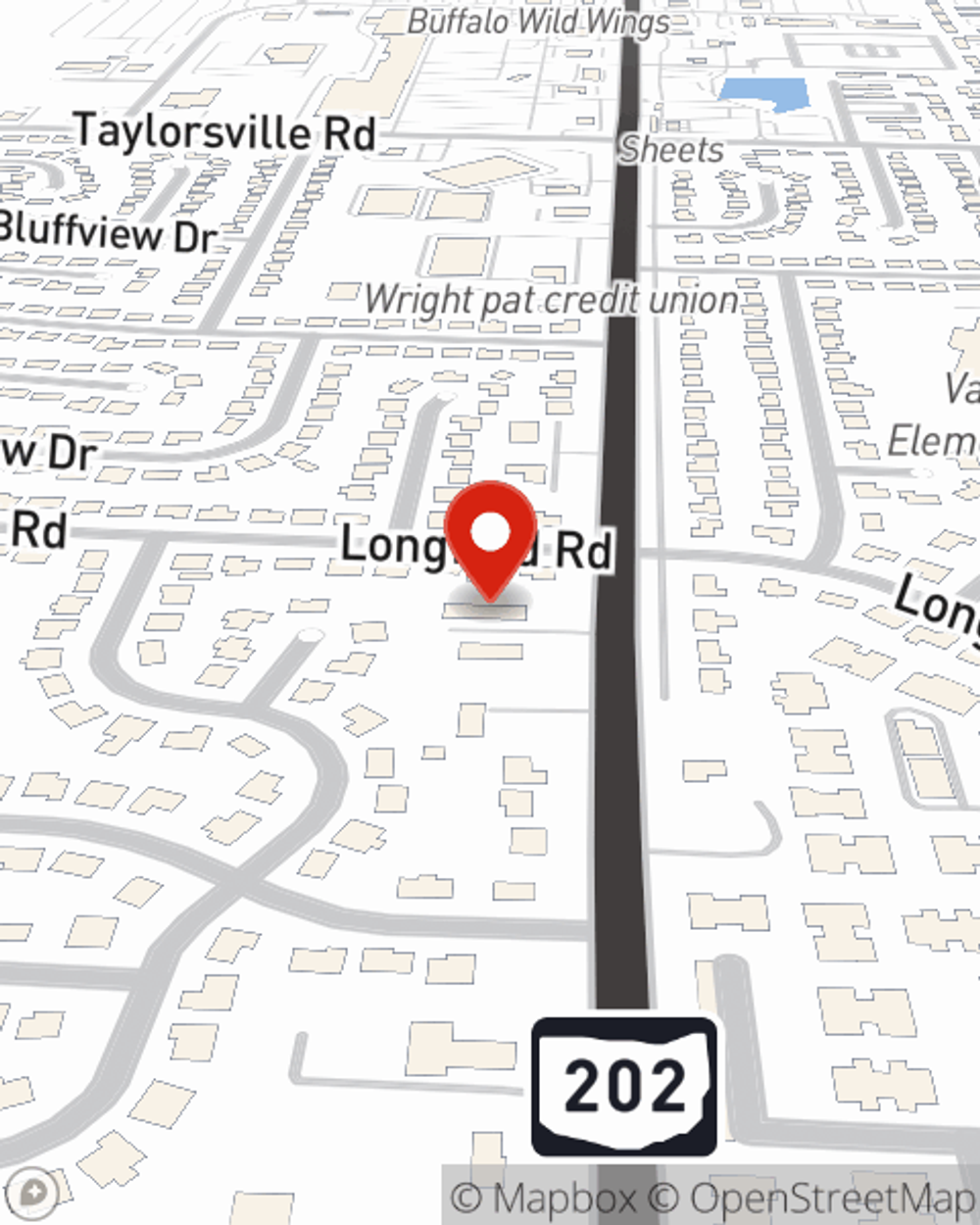

When your Huber Heights, OH, residence is insured by State Farm, even if something bad does happen, State Farm can help cover your one of your most valuable assets! Call or go online today and find out how State Farm agent Nathan Baker can help meet your condo unitowners insurance needs.

Have More Questions About Condo Unitowners Insurance?

Call Nathan at (937) 236-9950 or visit our FAQ page.

Simple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Nathan Baker

State Farm® Insurance AgentSimple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.