Homeowners Insurance in and around Huber Heights

Looking for homeowners insurance in Huber Heights?

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

Home Sweet Home Starts With State Farm

Your house isn't a home unless you enjoy coverage from State Farm. This excellent, secure homeowners insurance will help you protect what you value most.

Looking for homeowners insurance in Huber Heights?

Help protect your home with the right insurance for you.

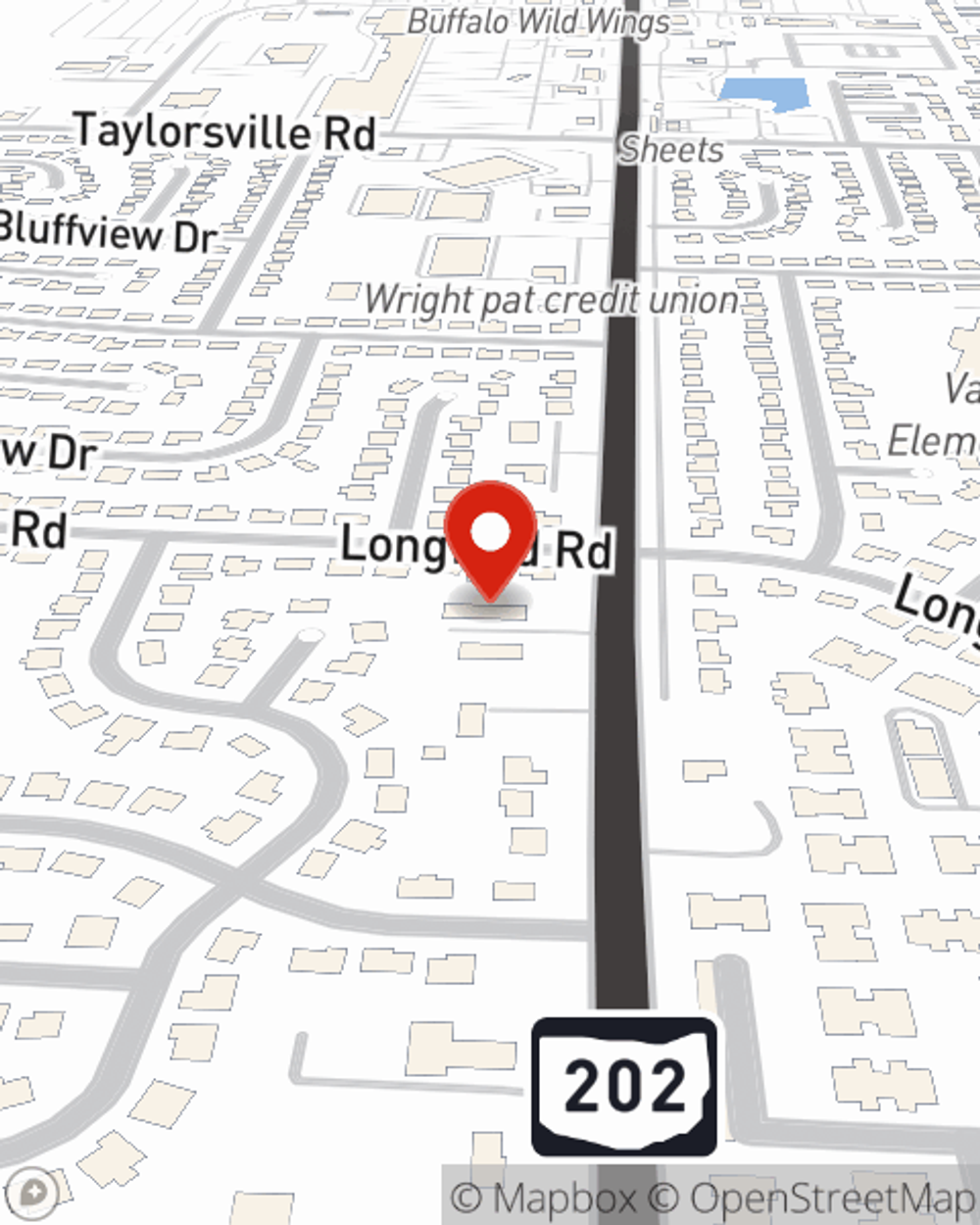

Agent Nathan Baker, At Your Service

You’ll get that and more with State Farm homeowner’s insurance. State Farm has coverage options to keep your home and everything in it safe. You’ll get a policy that’s modified to accommodate your specific needs. Fortunately you won’t have to figure that out on your own. With true commitment and excellent customer service, Agent Nathan Baker can walk you through every step to create a policy that shields your home and everything you’ve invested in.

More homeowners choose State Farm® as their home insurance company over any other insurer. Huber Heights homeowners, are you ready to find out what a company that helps customers by handling thousands of claims each day can do for you? Get in touch with State Farm Agent Nathan Baker today.

Have More Questions About Homeowners Insurance?

Call Nathan at (937) 236-9950 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Nathan Baker

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.